Is Regal Assets legit? That’s probably the first question that comes to your mind when you see the ads from this company. Their tagline is to diversify and grow your IRA, but what exactly do they do? My comprehensive review will explain if this is the right investment for your future.

Is Regal Assets legit? That’s probably the first question that comes to your mind when you see the ads from this company. Their tagline is to diversify and grow your IRA, but what exactly do they do? My comprehensive review will explain if this is the right investment for your future.

What Is Regal Assets?

Regal Assets is a prominent name in the gold and precious metal investment industry. Its primary aim is to help people secure their investments and savings through gold-backed IRAs, which have proven more stable than the relatively volatile alternatives of stocks, bonds, and mutual funds investments.

A full 95% of its business is in rollover IRAs, but the company also offers savings and investment programs based on gold, silver, platinum, palladium, and, since 2017, cryptocurrency. These programs vary according to your goals, whether they are for building your wealth, securing your family’s future, or simply diversifying your portfolio.

Gold, just like other commodities, is traded on the foreign exchange, so you can be making money on forex by purchasing gold, silver, and other assets. Regal Assets makes your experience in buying gold or investing in cryptocurrency a confident experience.

Regal Assets was founded in 2009, and by 2010 had already secured an A+, its highest. By 2013, Regal Assets had become an Inc. 500 company and was ranked number 20 of the financial services in the United States. In 2018 it became an official Forbes Finance Council member and has been ranked number 1 for the last 7 years in the gold IRA industry.

How Much Does It Cost to Invest?

Regal Assets has a relatively low fee structure at about $250 per year. This includes a $100 administration fee and a $150 storage fee. There are no initial setup costs, and fees are waived for the first year, not kicking in until year two. However, the funds required as initial investments may be a bit on the high side. The minimum required for an IRA rollover is $10,000.

Regal Assets does offer several types of investments other than the traditional IRA. There are two different types of personal packages available. The Merchant package, designed to provide an investment that can be readily liquified in time of need, requires a minimum investment of $5000. The Knighthood Package, for those wishing to provide financial coverage for the family, requires an investment of $10,000.

For investment purposes, Regal Assets offers four levels of gold portfolios. They are:

- $25,000 Legacy Portfolio, which is focused on immediate profit.

- $50,000 Kingship Portfolio, custom-designed to protect investors from inflation.

- $100,000 Dynasty Portfolio, which offers a substantial return on the initial investment. It has also proven to be stable against inflation and other economic trouble.

- $250,000+ Coronation Portfolio, designed for investors with a high net worth who want to concentrate on building wealth on a long term basis.

As mentioned before, the fees for Regal Assets services are uniform, at $250 per year. They are not based on the amount invested. When you purchase precious metals, any fees are included in the price quoted to you by your investment counselor, and you will never be subject to additional fees. Once the quoted price is locked in, it will not change, regardless of fluctuations in the market.

You should also note that the annual fee which you pay for storage of the gold in your IRA account provides for completely segregated storage of your assets. This means that your assets will be stored separately from other investors’ assets, and not just co-mingled in a single storage facility.

Other companies may offer such service, as well, but at a significantly higher price. And, when you choose to withdraw your coins, bars, or bullion from their storage site, it will be shipped to you immediately within seven days which is well below the 14 day average for other companies. If they do not meet this goal, you will receive a silver American eagle coin as compensation.

The Advantages of Investing with Regal Assets

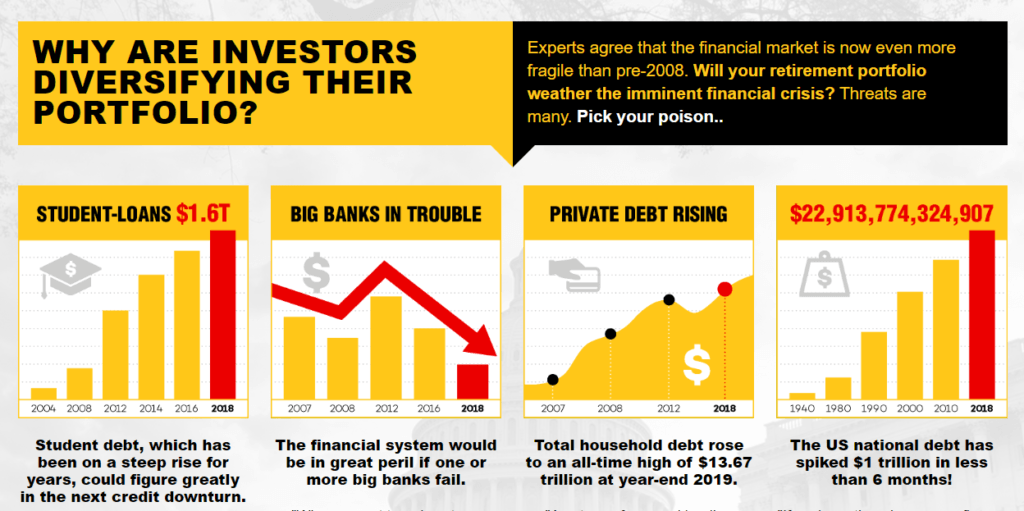

Many of you are certainly aware of the investment benefits in commodities other than stocks, bonds, and mutual funds, all of which are currency based. However, these currency values can fluctuate dramatically with the economic recessions, political turmoil, or a global pandemic, as what we’re experiencing right now.

Yet gold and other precious metals are far less vulnerable to these conditions. They have an intrinsic value which provides certain advantages over the so-called fiat currencies, which only have value because people agree that they do.

Investing in gold and other precious metals allowed you to preserve the value of your investment. These types of investments offer liquidity because they are always in demand, and you can diversify your investments by adding gold bars or coins.

Investing in gold and other precious metals provides protection against hyperinflation and a value immune to economic influences.

That’s why it is the most stable investment you can make. Regal Assets also provides the opportunity to invest in digital assets, cryptocurrencies such as Bitcoin, Litecoin, Etherium, and XRP, providing custodial storage for these assets as well as the more solid metallic variety.

Regal Assets, while offering investments in gold, silver, platinum, palladium, and cryptocurrency are primarily involved in rolling over your IRA or 401K accounts into gold. These are assets that you may not fully appreciate but merely salt away for the future.

Now, imagine if that stack of paper assets, so susceptible to devaluation by economic downswings, can be converted into the solid asset of gold bars and/or coins. Or even the more modern, esoteric commodity of cryptocurrency. IRA’s are regulated by federal tax law, and, while you may find these laws somewhat confusing, the consultants at Regal Assets are always ready to help you navigate through the labyrinth.

They are familiar with any and all tax laws, and know-how to keep you in compliance. Thus, they are able to assist you in every aspect of your investment experience, from advising you on prices, laws, right down to filling in the paperwork. And there are never any high-pressure sales pitches.

Those sorts of tactics are forbidden by the company, and all sales calls are monitored to ensure that this never happens. Bear in mind that your precious metal and digital IRA assets will be considered as cash as soon as they are delivered to you, so, for this reason, they must be stored securely. Your assets will be stored by Regal Assets, to be delivered to you when appropriate.

Investments on paper, stocks, bonds, and the like, are not considered cash until they have been redeemed. Gold, however, is a cash asset and must be kept in a secure location. If it is delivered to you, this is considered a withdrawal and is subject to any taxes due at the time of delivery.

As you know, the U.S. currency was formerly tied to the value of gold. This is called the gold standard. But this is no longer the case. The value of gold is completely independent of that of the dollar. In fact, their values tend to be in inverse proportion. This means, when the dollar goes down, the value of gold goes up, insulating you from any deflation of your assets held in gold.

Regal Assets also operates through a robust referral program, allowing affiliate marketers to earn a competitive commission; up to $100 for every qualified lead and sale and 3% of the total investment (an average of $1,950) made by a new customer.

The Regal Assets affiliate program is offered worldwide and is opened to all levels of marketing experience, including financial professionals. However, they do require you to have an active website, preferably one that is related to the money and finance niche. This is part of their screening process to ensure you’re eligible to promote their products.

If you need a website quick and fast, consider using this WordPress builder to create one and then, link to a custom domain of your own choice.

At the bottom line, the reason you should be investing with Regal Assets is that you should always deal with a company you can trust. As you can see, there are many advantages to investing in gold and other precious metals and cryptocurrencies, or to roll over your IRA’s and 401K’s into gold rather than paper.

But these advantages mean nothing if you can’t trust the company with which you are dealing. You have only to look at customer satisfaction surveys, online reviews, or investigate Regal Assets in INC. Magazine or Fobes, or check them out at the Better Business Bureau to know that this is a company you can trust with your money and your future.

The Disadvantages of Investing with Regal Assets

If you search the web, you will find very little argument against investing with this company, but there have been a few issues. The company is said to possess a smaller inventory of bullion than other competitive companies. There have been a couple of complaints about delivery times, but these seem to have all been resolved.

In fact, Regal Assets is known to have the fastest delivery times in the industry, with only seven days from purchase to delivery, but evidently, there have been a few glitches.

The major disadvantage seems to be that Regal Assets is not really designed for small investors. IRA rollovers require a minimum transaction of $10,000, which doesn’t seem too extravagant when we’re talking about retirement savings. But individual purchasing options start at $5,000, an amount that may be beyond the reach of many small investors.

Is Regal Assets Legit?

Regal Assets is certainly a legit company. They have been in business since 2008, and have been steadily growing since. Customers have offered up almost universally glowing reviews, and publications such as Inc, Magazine, and Fortune have echoed these sentiments.

Regal Assets differ from certain gold investment scams or make money online programs in a number of ways. They never advocate any high-pressure sales tactics and will never make claims of extravagant returns on your investments, knowing that profits are strongly dependent on the marketplace.

They will advise you about trends, but at the end of the day, the decision is yours to make. Remember, if it sounds too good to be true, it probably is!

Gold buying scams are rampant, as you are buying assets which you may not even see, but are held in the company’s storage facility. This could be like buying the proverbial pig in a poke. If you are determined to purchase said pig, make sure you do it from a reputable seller such as Regal Assets.

What If You Don’t Have The Money to Invest?

Diversifying one’s portfolio during these challenging economic times is crucial, but let’s face it, not everyone can afford $5K much less, $10K for this type of investment scheme. Should you find yourself in this situation, there’s one more option you can take without breaking the bank.

Ever thought of starting an online business? You can capitalize on various eCommerce trends, selling your own stuff, or promoting other people’s products. There are thousands, if not millions to be made in a single niche and all you need is just $1 per day to get started.

If you’re interested in learning more about this opportunity, sign up for free at my recommended training platform here.

Well, I hope this review has provided you significant insights into what Regal Assets is all about. Let us know in the comment below if you’ve any questions/thoughts or similar investing experience.

This is rather interesting; gold has been a very high commodity that I have always been interested in to have and also store up my savings in because of the regulations towards its volatility. Though gold can be lousy at times generally, it has a more controlled way of movement and that makes it a lot better for investment.

Your review helped me to understand why my friends have been really bent on me investing in Regal Assets. I’m keen to give this a try seeing that gold values have surged since the pandemic outbreak. Thanks!

An exceptional review you have here, Cathy. I have been hearing about this whole investment in gold but never thought about giving it a try myself. Regal Assets seem to have some very interesting offers that can be inflation-proof. The one big problem however is the minimum fee to join. 5K is a hefty amount and it’s kind of off-putting for a fresh grad like me.