Depending on who you talk to, personal investing can seem like a rather big, small or confusing term. If you belong to the latter group of people, things are about to change after you read this post. Today, we’ll be learning how to use the Acorns app, not only to make some extra cash but also to grow your wealth into the future. You’d be so pumped up to start saving after this – I promised.

What is Acorns?

Acorns is a micro-investment app that lets you ‘squirrel’ away tiny little amounts of money and it’s available in both Android and iOS. These tiny amounts go towards bigger investments – think penny stocks in “The Wolf of Wall Street”.

It has been earmarked as the way that investments will be made in the future, especially with the advances expected in digital technology.

Micro-investments are proving ridiculously popular among millennials and the younger generations. They allow you to speculate, accumulate and theoretically learn the game of stocks and shares – all with minimal risk to the self.

What is micro-investing? We hear you asked.

Well, it stems from the idea that every penny counts, but applied to the investment world. A micro-investing app like Acorns allows millions of users to contribute a very small amount, and get a little ROI for their money.

The app comes in three types of accounts where the money is accumulated and accessed;

- Core Investment Account – funds from this account are used for investment and for withdrawal.

- Acorns Spend – a mobile checking account that supplies a debit Visa card to allow you to make purchases using your investment funds easily. When using this card, there are no fees for ATMs, no overdraft fees and no minimum balance requirements.

- Acorns Later – lets you set up individual retirement accounts such as ROTH IRA, traditional IRA or SEP IRA.

While the app is free to download, it’s not entirely free to use. It costs $1 per month for the core account, $2 for core plus retirement account and $3 to access all three accounts.

To get started, you will create an account and answer a couple of questions regarding your investment objectives and financial goals. This information will determine which portfolio suits you later.

Acorns pride itself as an automated saving and investment app, but do you know how it actually works?

How Does Acorns Invest Your Money?

The idea behind Acorns is that you can invest small amounts of cash, passively into something bigger. Also known as Round-Ups, this first automation feature is linked to your debit and credit cards and it allows you to invest spare change into your core account whenever you buy something through these cards.

The second automation is the Recurring Payment you make to the app. You can choose any amount to invest at any time interval you like. For example, if you set $10 every week, the app will withdraw $10 from your bank account to your investment account on a weekly basis.

The third automation is known as the Earn Found Money and it lets you earn cashback and rewards whenever online purchases are made from brands that partners with Acorns. For example, Blue Apron will give you $30 when signing up. When you shop with Expedia you get 4% off your purchase.

Cashback also applies to local outlets near you, so when you are dining at a restaurant and buying something from a local outlet, be sure to check out if they are Acorns partners. All cashback will then be directed as micro-investment into your core account.

So where is all your money going to with all these automation? With Acorns, your money is invested into ETFs aka as low-cost exchange-traded funds. These are marketable securities that contain multiple underlying assets such as stocks, commodities, and bonds.

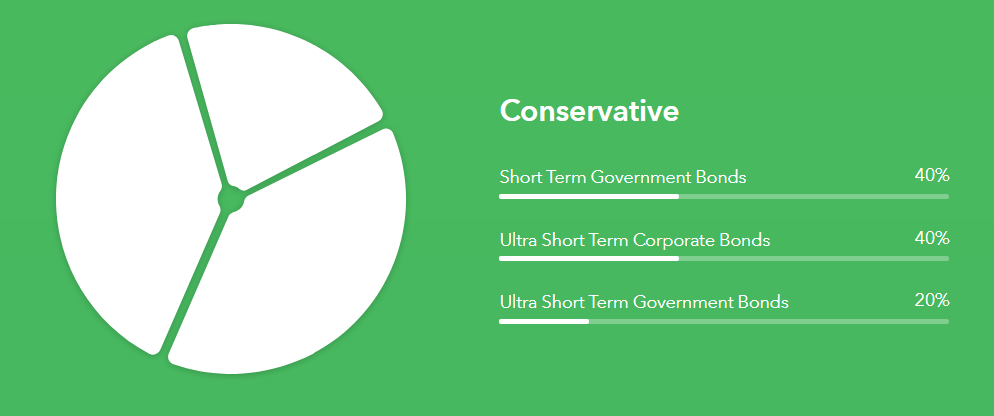

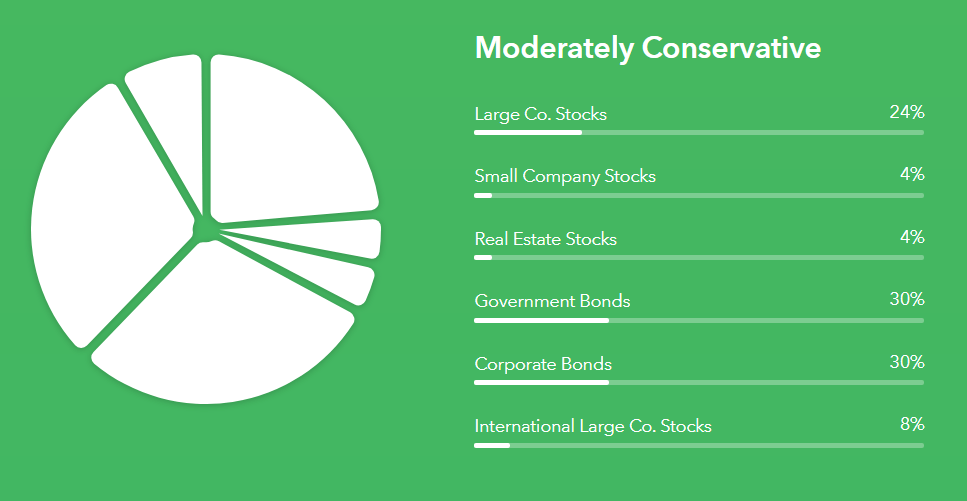

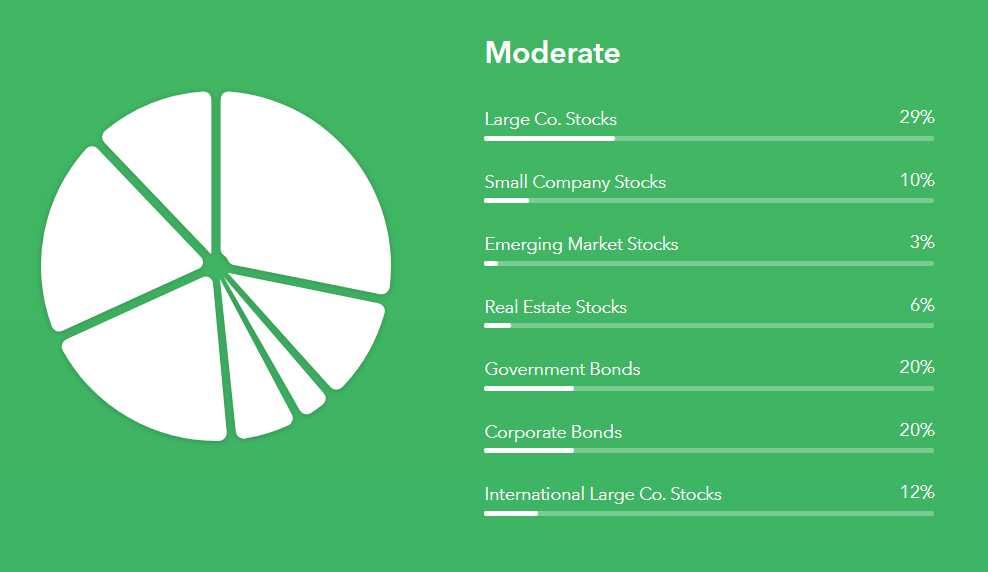

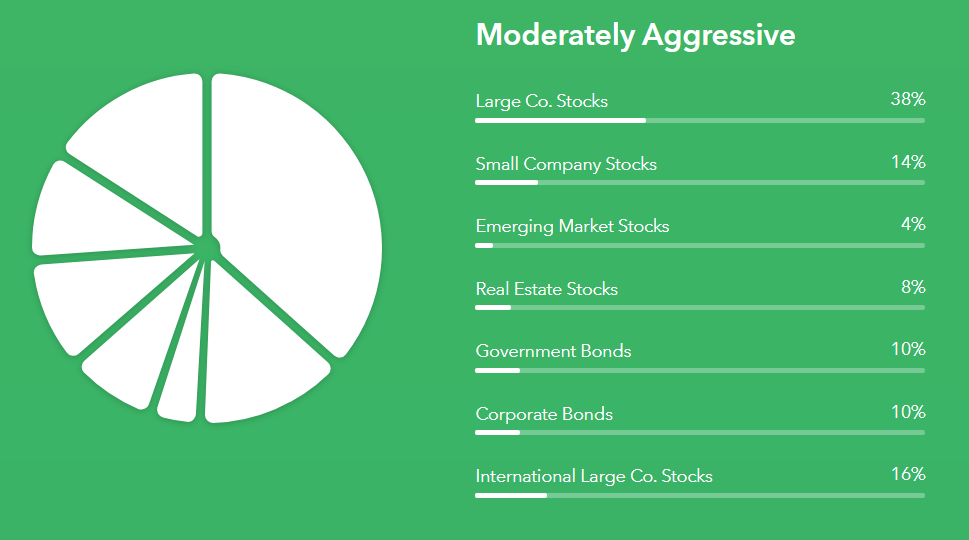

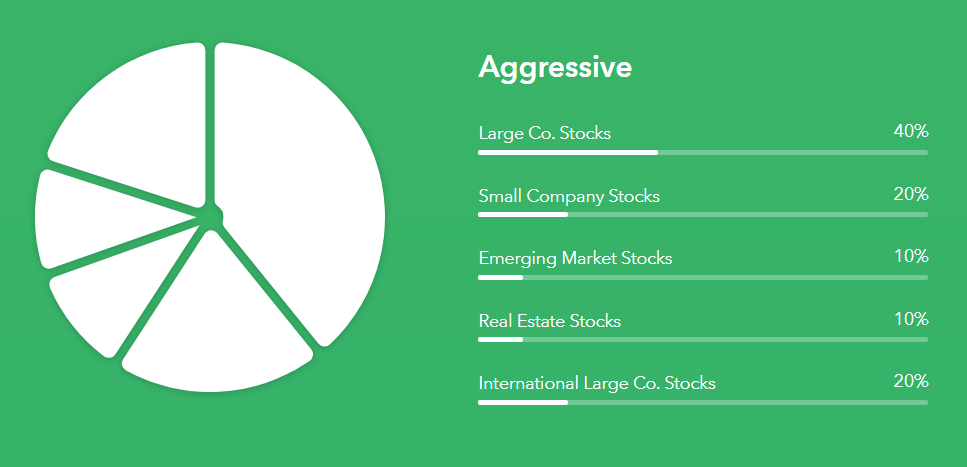

There are 5 investment portfolios that have been pre-built into the system and you only need to choose one based on the level of risk you are willing to take. Each portfolio is diverse and they are made up of several asset classes as seen below.

The market’s gain or loss over a period of time will be reflected in each investment and based on the performance details, you can decide whether to stay or to switch to a different portfolio as you like. To withdraw funds, simply enter the desired value and make sure you are connected to a bank account.

The Advantages of Using Acorns

So if we were to take an at-a-glance view of the app, what are the good points? Here are some of the pros worth mentioning.

- The app is basically clutter-free, easy to navigate and user-friendly. It makes investing less intimidating for beginners.

- The app is generally safe to invest as it is SIPC insured up to $500,000 for the core and retirement account and FDIC insured up to $250,000 for the Spend account. As the site is SSL encrypted, personal information can only be accessed by you and Acorn itself.

- For as little as $5, you can start investing and saving for retirement. This encourages more young people to think seriously about their future financial situation and start saving from an early age.

- Many popular brands like Amazon, Walmart and Asos are partners of Acorns so if you are already a customer at these outlets, you should definitely make money from your credit cards by earning more cash back rewards.

- Since portfolios are already prebuilt, there’s no need to buy, sell or research on stocks which can be quite complex to digest for most beginners.

- The good news is, if you are a college student with a valid .edu address, you can use the core account for free up to 4 years.

- Besides acting as an investment app, Acorns has loads of educational resources to help you learn about money management and future investing so make sure to check that out.

- If you are an active user with Acorns, you should definitely apply for the referral program and earn extra money introducing new users to the app. When someone made their first investment, he/she will get a $5 sign-up bonus and you’ll make $5 per referral towards your core account. Sometimes, the referral commissions could even go up to as high as $250.

One of the best ways to promote the Acorns app is through blogging or YouTube videos and it works very much like affiliate marketing. You create a content (a blog post or a video) targeting an audience and place the referral link to lead visitors to the app.

If discussing about money and growing wealth are the topics that interest you, why not start a finance blog using the builder tool down below? It’s free

The Downside of Using Acorns

As intelligent as it may be, Acorns do have some shortcomings. When using the app to grow extra cash on the side, consider the following setbacks;

- You need to be 18 years old to open an account, so even though it teaches you how to manage money, it can’t do it until you’re at the age whereby ‘money responsibility’ is on the mind.

- The app is only available for US and Australia based users. If you are from other parts of the world, check how you can invest in stocks in your local market. Chances are, there are a growing number of micro-investment apps similar to Acorns.

- While the monthly usage fees are rather low in maintenance, experts reckon that you should have at least $100 in your portfolio, to justify paying for the accounts over the long term period.

- Limited asset classes mean that you can’t invest in individual stocks for better returns. Active stock traders may not find these profiles appealing either.

- Lastly, Acorns investment doesn’t offer any tax benefits so there aren’t many savings to be done during the taxation period.

Is Acorns A Good Investment Tool?

Acorns is an easy to use yet versatile tool for investment, mobile banking, cashback, and retirement – all in one platform. While it cannot guarantee the performance of the stock markets, it does provide a digital control for millennials to get into the habit of planning for their financial situation, now and into the future.

As digital reliance grows, the demand for this type of app will become more common amongst tech-savvy users. So will the awareness for anything that makes money online.

One of my favorite way of investing is to start a blog on something that people are interested to read. Using affiliate programs, you can find relevant products and services to be recommended through a blog without having to create any products yourself.

In the long run, that blog essentially becomes a virtual real estate that appreciates in value and should you decide to sell off the site someday, it could fetch a pretty lucrative ROI for your investment.

Visit my go-to training site to learn more about starting a blogging business for free and if you have any comments or questions regarding the Acorns app, simply leave them in the space down below.

I like the idea of using spare change as an investment – though the amount can be small, over time this can be substantial (think of the jars full of pennies and change we used to use). But I do think you need to start with at least $400 to $500 just to break even.

I started early with investing, but many young people today have not started, which I think they should.

For those who may not have any other savings and investment plan in place, this is a good mechanism to get them started.

I did not know that Acorns gave cashback and other bonuses when you use their app. I thought it was just a spare change investing app. While I do not care for spare change investing as I may need those cents, I am interested in earning interest and getting cashback. Acorns seems to provide a good alternative to other investing apps.

Well, now you know Jon.

What an interesting investment tool! Can someone from the Philippines use this app?

Unfortunately, it’s only available for people residing in the US and Australia.

That was an interesting article about the Acorn App. I think it would be a great way for young people to get into investing and saving habits from early on. It gives you more insight into what is happening to your money.

Directing small changes into investing makes you realize that even small amounts of money are worth putting together to make a bigger investment. I can see how using the app could become a personal challenge and almost like a game, by constantly adding to what you save. It will also highlight the power of compounding interest.

It is a bit of a shame that it cannot be used by people under 18 years of age as I think it is a good budgeting tool and makes you more aware of money management. I suppose there are some other apps that would suit younger people.

I might look into that for my grandchildren as I think money management is important and should be taught in schools. But that is another discussion.

Most portfolios need you to be 18 years old and above to invest in stocks – I guess that’s why.

I used another micro-investment app one other time. I quit using it because it became incompatible with my bank account. I liked it however, it didn’t work out for me. You have convinced me to give Acorn a try. I like that it has a referral program as well.