I know what you are thinking about. Isn’t credit card something you spend money on? How is it possible that you can cash out from all those daily transactions? Well, there are smart ways to do that and I am about to show you how to make money from credit cards even when you have never done it before.

I know what you are thinking about. Isn’t credit card something you spend money on? How is it possible that you can cash out from all those daily transactions? Well, there are smart ways to do that and I am about to show you how to make money from credit cards even when you have never done it before.

Whether you are an existing credit card holder or about to get one, I am sure this article will benefit you one way or the other.

Making Money From Credit Cards – Why Should You Care?

‘Credit card’ used to be a scary word. Twenty years ago, owning one was like an admission that you couldn’t manage your finances without borrowing from a credit firm once a month. As time passed and more companies arose, the competition for customers increases too.

Credit card companies started to offer better and better deals to attract new clientele. Over the years this has developed into a lucrative way for you to earn extra cash without having to exert yourself too much.

Credit card debt is still thought of as ‘bad debt‘ (as opposed to ‘good debt’ like your mortgage) but if you use them frequently for small purchases, you can actually earn extra cash while you do things like shop, spend money online, or take advantage of the special offers the competitive credit card market has to offer.

There are a number of different types of credit cards. Some of these are as follows:

- The 0% Balance Transfer Card – Lets you transfer existing debt and pay it off, interest-free.

- Cashback Cards – These let you earn cash while you shop.

- The Interest-Free Card – Some card companies offer interest-free rates for lengthy periods.

- Credit Card for Bad Credit – These firms target those trying to rebuild their credit score.

- The Prepaid Card – Not technically a credit card but great for teenagers.

- Low Rate Card – Cards with low appreciation.

So how do you make the most of a credit card and harness its potential to make you some money? Let’s talk about how you might monetize your cards and see if we can’t make you some cash!

6 Smart Monetizing Ways

There are a number of ways to monetize your credit card foray and I have listed some of the most popular, below.

1 – Cashback

Cashback credit cards let you earn back some money you spend while doing your regular shopping. The only change you might need to make is to shop online a little more but that should be pretty common nowadays with eCommerce. Cashback rates on credit cards typically sit around the 0.5-5% mark, meaning that this percentage is returned to you from each purchase.

Credit cards aren’t the only way to get cashback though. Sites like Topcashback and Rakuten Ebates partner with many retailers, allowing you to spend money on regular purchases while making some commission from using their links. If you do this often enough, you could end up with a tidy sum simply for changing the way you do daily grocery shopping. It all adds up in the long run.

2 – Rewards

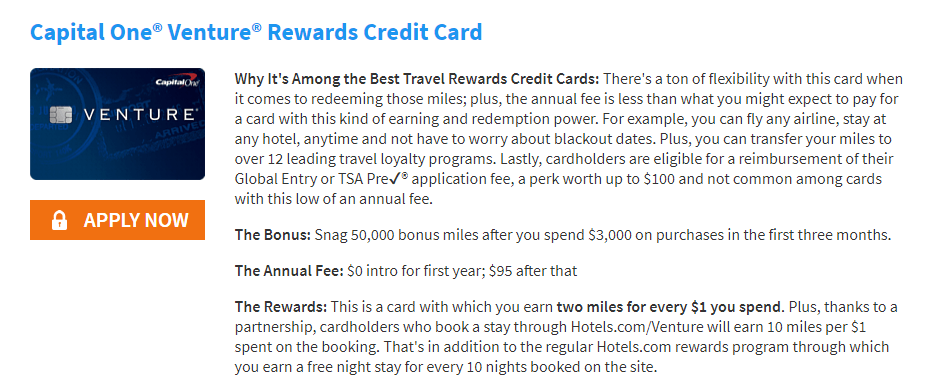

If you travel around a lot (and most of us spend a small fortune on travel fuel), then travel-based credit cards could work wonders for you. Many travel-based credit cards have gift cards as rewards for purchases made in specific areas. These areas might be grocery shopping, or petrol, or entertainment outlets.

All cards have different rewards for different bonus spends. Learning what these are can get you gift cards galore when it comes time to shopping for presents. Mile points are easy to collect if you have the right card so do thorough research on which credit cards offer you rewards for miles traveled by air, road or rail.

Certain airlines also have their own credit cards that enable you to rack up frequent flyer miles. If you can accumulate enough miles, you can actually fly for free once in a while. Don’t you think that’s a pretty good deal?

3 – Sign Up Bonuses

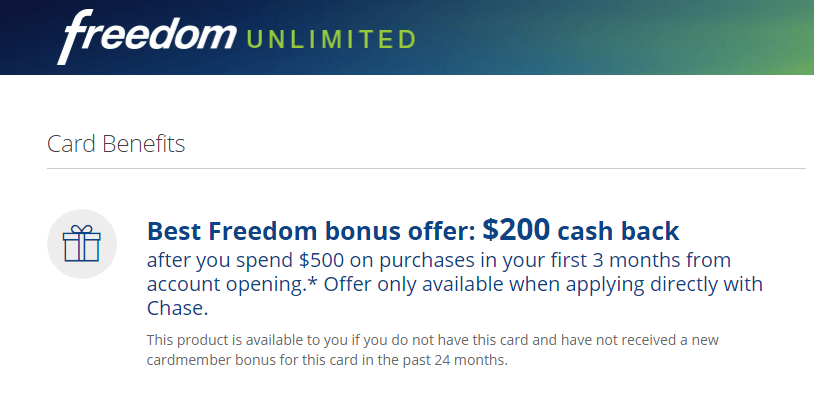

Sign up bonuses for credit cards vary from nothing to thousands of points (translate to hundreds of dollars). When the market is hot and the competition is its fiercest, you ought to be able to bag a bargain in bonus points simply for signing up.

Sign up bonuses for credit cards vary from nothing to thousands of points (translate to hundreds of dollars). When the market is hot and the competition is its fiercest, you ought to be able to bag a bargain in bonus points simply for signing up.

There is a caution though, as some of these bonuses come with a catch. You might sign up expecting 3000 bonus points only to find out that it’s only possible when you reach a certain spending limit. So make sure you are aware of that.

Timing your application until right before a big-budget project can help you save money, as can keeping an eye on deadlines, paying everything on time, and combining the sign-up bonuses with spending on gift cards to maximize the points value you accrue.

They also suggest that you put every possible payment on your credit card and settle it at the end of the month if you want to make serious cash.

4 – Invest Cashback

We all love that feeling at the end of the quarter, or at the end of the year or month when you get your lump sum back from all your cashback purchasing. It’s a rewarding feeling to open your credit card account and see the balance. Though we are all sorely tempted to spend the cash backs, we could actually be making more if we re-invested them instead.

Your credit card will offer you the option to have the payment made into your account but they should also allow you to convert that amount into more points, gift vouchers, or some other product that will ultimately earn you even more points. Investing cashback by putting it back into your credit card will only serve to make you more money the next time around.

Repeat this a few times and you should see a nice profit.

5 – Invest in Acorns

Acorns is a wonderful little scheme that helps you to save up for retirement, squirrel away your spare change, and make better financial decisions in the long run. They have a round-up service that will take your spare change up to the nearest dollar, then send it to whichever savings account you assign it to. This handy little service is even available as a phone app, so you can manage your expenses while on-the-go.

As well as helping you save, Acorns provides a debit card that invests when you make a purchase. They have more than 300 brands to choose from, all of which are available for investment. Acorns is truly a service that serves for a future living since micro-investments seem to be the financial trend in times to come.

Get started in the business now and you will be more prepared in taking bigger risks that may (or may not) lie ahead.

6 – Credit Card Affiliate Programs

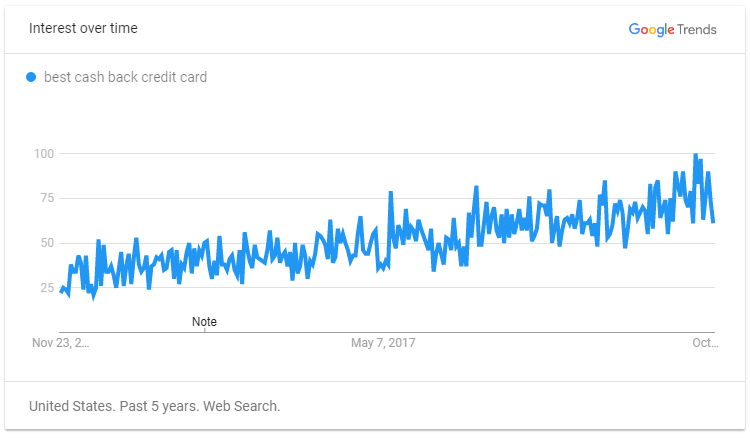

How many of you have searched on the internet to look credit card and actually apply online? Probably a handful and when that happens, do you know that the recommending websites actually make a small profit from referrals?

That’s the mechanism of credit card affiliate programs and it’s a pretty lucrative business due to two main factors;

- There’s a huge supply – Besides what the bank offers, there are many choices of cards to choose from nowadays such as cashback, travel, gas & restaurant, student, NHL, and business cards.

- There’s a huge demand – More people are actively searching for the right cards to suit their spending budget and lifestyle.

Put these two markets together and you get a winning formula for affiliate marketing.

Credit card companies are now paying for customer referrals (some up to $100 per lead) and offering new customers sign-up bonuses. This win-win situation is what makes applying for a credit card online so popular nowadays.

If you are someone who’s interested in discussing finance and money management, you should definitely join these programs. But first, you need to create a finance blog that gets substantial traffic because credit card companies usually look for highly qualifying sites to be their affiliates.

Never had experience building a blog? Use this free tool to get started.

If you can prove yourself as an authority in this niche, consider applying through the following affiliate networks that list plenty of credit card/financial services offers;

- FlexOffers Affiliate Network (includes products and services from other verticals)

- CJ Affiliate (also includes products and services from other verticals

- Credit.com (only offers finance-related products)

- Discover.com (only offers finance-related products)

- Bank Rate (only offers finance-related products)

Or apply directly through the financial institution itself. You can Google search for “X Credit Card Affiliate Program” but keep in mind they are sometimes known as referral programs as well.

If you like to learn more about earning as an affiliate marketer, please check out my recommended training platform here.

It Pays to Be Financially Savvy

Don’t just focus on paying off debts and building good credit. Now that you know how to make money from credit cards, take advantage of that to create more savings and possibly establish an additional income stream. With the internet, there are more opportunities now than before.

Read my personal journey here to learn more about becoming financially savvy and time free through creating an online business.

My only experience promoting a card online was when I became an affiliate marketer for Payoneer which is like a debit card and not a credit card. Your post made me realized that it is also possible to promote credit cards as well. Truly, the financial service sector offers one of the most lucrative commissions among all opportunities available for affiliate marketers.

Yes, but you have to be quite sound in financial knowledge to be able to join those programs. Creating a money blog can help build a good foundation for you to aggregate these topics and build your credentials in this niche.

Hello Cathy, it’s wonderful how you coke across some vital information when needed. Truly, on hearing credit cards, I first wasn’t sure of what I saw and when I got to the point where I can make money after paying for things, I was perplexed.

Being much of a traveler, I understand how much you could spend on trips, but getting rewards for your travel credit card can save a lot of money and makes traveling more fun.

Exactly. I have a friend who holds only travel credit cards and he flies for free around the US every year for his vacation. It’s pretty cool when you have the strategy for spending the money.

I think I am starting to understand what this credit card making money is all about. If we spend a lot on shopping and eat outs, then using cashback cards really makes sense. Why pay the full amount if you can pay for less, right?

Exactly. Shopping using cashback can help save a lot of money.

I respect people who can handle credit and credit cards wisely. I’m not one of them, as evinced by the fact that I’m in the process of paying off two court lawsuits. If only I could have your savvy before going into savage debt. I hope many people read this before they get excited about spending on their cards or out of temptation, which seems to be the case nowadays.

I hope you are able to get out of your debt soon, Cathy. It’s never too late to start.

Honestly, most people are not aware of the fact that they can actually make money from credit cards. Thanks for shedding light on this topic. Cashback is the best way and I think people who travel a lot should make the most out of their reward points if there’s any.

Yup, air miles points are something worth looking into because if you are serious about it, it would allow you to travel for free.

This is surprisingly exciting. Never thought that credit cards can become a source for earning money. I always use mine for purchasing and paying for expenses. After reading some of the suggestions here, I wonder what kind of benefits and perks my card company has to offer.

Hi Aysha, not many people take full advantage of their credit card. It’s a good idea to sign up for the newsletter and get updates about regular promotions. My card company sends me SMS text all the time so I know which retail shops, petrol stations or restaurants to go to earn cashback.